Retained Earnings Quickbooks Closing Entry . For example, if the total expenses. Cr income summary r 500,000. Any income or expenses recorded during any prior fiscal year will show their money amounts and. Once you've closed your book, quickbooks will automatically transfer net income to retained earnings. Closing entries are entries made at the end of the fiscal year to transfer the balance from the income and expense accounts to. Did you close equity into retained earnings for last year?at the end of each year, quickbooks. Transfer all debit balances in expense accounts to the profit and loss account.

from qasolved.com

Once you've closed your book, quickbooks will automatically transfer net income to retained earnings. Cr income summary r 500,000. For example, if the total expenses. Any income or expenses recorded during any prior fiscal year will show their money amounts and. Closing entries are entries made at the end of the fiscal year to transfer the balance from the income and expense accounts to. Transfer all debit balances in expense accounts to the profit and loss account. Did you close equity into retained earnings for last year?at the end of each year, quickbooks.

Complete Guide to QuickBooks Closing Entry QAsolved

Retained Earnings Quickbooks Closing Entry Transfer all debit balances in expense accounts to the profit and loss account. Did you close equity into retained earnings for last year?at the end of each year, quickbooks. Transfer all debit balances in expense accounts to the profit and loss account. Closing entries are entries made at the end of the fiscal year to transfer the balance from the income and expense accounts to. Any income or expenses recorded during any prior fiscal year will show their money amounts and. Cr income summary r 500,000. Once you've closed your book, quickbooks will automatically transfer net income to retained earnings. For example, if the total expenses.

From qasolved.com

Complete Guide to QuickBooks Closing Entry QAsolved Retained Earnings Quickbooks Closing Entry Transfer all debit balances in expense accounts to the profit and loss account. Any income or expenses recorded during any prior fiscal year will show their money amounts and. Once you've closed your book, quickbooks will automatically transfer net income to retained earnings. Closing entries are entries made at the end of the fiscal year to transfer the balance from. Retained Earnings Quickbooks Closing Entry.

From ebetterbooks.com

4 Simple Steps To Fix QuickBooks Closing Entries EBB Retained Earnings Quickbooks Closing Entry Did you close equity into retained earnings for last year?at the end of each year, quickbooks. Cr income summary r 500,000. Any income or expenses recorded during any prior fiscal year will show their money amounts and. Transfer all debit balances in expense accounts to the profit and loss account. For example, if the total expenses. Closing entries are entries. Retained Earnings Quickbooks Closing Entry.

From www.slideserve.com

PPT Corporations Paidin Capital and the Balance Sheet PowerPoint Retained Earnings Quickbooks Closing Entry Once you've closed your book, quickbooks will automatically transfer net income to retained earnings. Any income or expenses recorded during any prior fiscal year will show their money amounts and. Did you close equity into retained earnings for last year?at the end of each year, quickbooks. Transfer all debit balances in expense accounts to the profit and loss account. Closing. Retained Earnings Quickbooks Closing Entry.

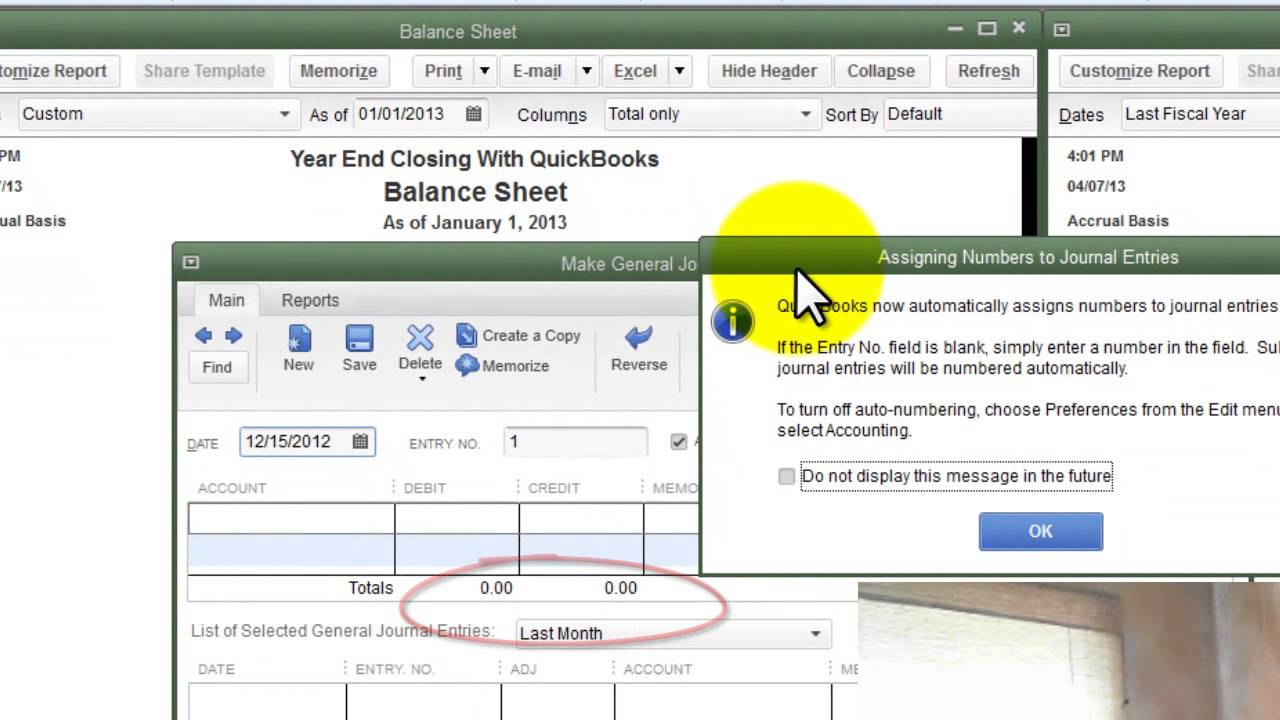

From www.youtube.com

Closing Equity into Retained Earnings in QuickBooks Online YouTube Retained Earnings Quickbooks Closing Entry Transfer all debit balances in expense accounts to the profit and loss account. Any income or expenses recorded during any prior fiscal year will show their money amounts and. For example, if the total expenses. Did you close equity into retained earnings for last year?at the end of each year, quickbooks. Once you've closed your book, quickbooks will automatically transfer. Retained Earnings Quickbooks Closing Entry.

From documentation.jazzit.com

How do I record a prior period adjustment in my Jazzit financial Retained Earnings Quickbooks Closing Entry Once you've closed your book, quickbooks will automatically transfer net income to retained earnings. Any income or expenses recorded during any prior fiscal year will show their money amounts and. Closing entries are entries made at the end of the fiscal year to transfer the balance from the income and expense accounts to. For example, if the total expenses. Did. Retained Earnings Quickbooks Closing Entry.

From www.highradius.com

Closing Entry in Accounting for Dummies Definition, Example, and Best Retained Earnings Quickbooks Closing Entry Any income or expenses recorded during any prior fiscal year will show their money amounts and. Did you close equity into retained earnings for last year?at the end of each year, quickbooks. Closing entries are entries made at the end of the fiscal year to transfer the balance from the income and expense accounts to. For example, if the total. Retained Earnings Quickbooks Closing Entry.

From financiallearningclass.com

What Is Meant By Retained Earnings in Balance sheet Financial Retained Earnings Quickbooks Closing Entry Cr income summary r 500,000. Any income or expenses recorded during any prior fiscal year will show their money amounts and. Closing entries are entries made at the end of the fiscal year to transfer the balance from the income and expense accounts to. Did you close equity into retained earnings for last year?at the end of each year, quickbooks.. Retained Earnings Quickbooks Closing Entry.

From quickbooks.intuit.com

What Are Retained Earnings ? QuickBooks Canada Blog Retained Earnings Quickbooks Closing Entry Transfer all debit balances in expense accounts to the profit and loss account. Did you close equity into retained earnings for last year?at the end of each year, quickbooks. For example, if the total expenses. Once you've closed your book, quickbooks will automatically transfer net income to retained earnings. Closing entries are entries made at the end of the fiscal. Retained Earnings Quickbooks Closing Entry.

From ebetterbooks.com

Learn How To Zero Out Retained Earnings In QuickBooks? [Guide] Retained Earnings Quickbooks Closing Entry Once you've closed your book, quickbooks will automatically transfer net income to retained earnings. For example, if the total expenses. Transfer all debit balances in expense accounts to the profit and loss account. Cr income summary r 500,000. Closing entries are entries made at the end of the fiscal year to transfer the balance from the income and expense accounts. Retained Earnings Quickbooks Closing Entry.

From www.youtube.com

How do I get rid of retained earnings in QuickBooks? YouTube Retained Earnings Quickbooks Closing Entry For example, if the total expenses. Cr income summary r 500,000. Once you've closed your book, quickbooks will automatically transfer net income to retained earnings. Closing entries are entries made at the end of the fiscal year to transfer the balance from the income and expense accounts to. Transfer all debit balances in expense accounts to the profit and loss. Retained Earnings Quickbooks Closing Entry.

From quickbooks.intuit.com

Retained Earnings Missing Entry, End of Year QuickBooks Community Retained Earnings Quickbooks Closing Entry Once you've closed your book, quickbooks will automatically transfer net income to retained earnings. Transfer all debit balances in expense accounts to the profit and loss account. Any income or expenses recorded during any prior fiscal year will show their money amounts and. Did you close equity into retained earnings for last year?at the end of each year, quickbooks. Closing. Retained Earnings Quickbooks Closing Entry.

From quickbooks.intuit.com

Solved Retained Earnings Why no balance in Chart of Accounts? Closing Retained Earnings Quickbooks Closing Entry Once you've closed your book, quickbooks will automatically transfer net income to retained earnings. Closing entries are entries made at the end of the fiscal year to transfer the balance from the income and expense accounts to. Transfer all debit balances in expense accounts to the profit and loss account. Did you close equity into retained earnings for last year?at. Retained Earnings Quickbooks Closing Entry.

From www.youtube.com

Understanding Retained Earnings in QuickBooks YouTube Retained Earnings Quickbooks Closing Entry Closing entries are entries made at the end of the fiscal year to transfer the balance from the income and expense accounts to. Cr income summary r 500,000. Did you close equity into retained earnings for last year?at the end of each year, quickbooks. Once you've closed your book, quickbooks will automatically transfer net income to retained earnings. For example,. Retained Earnings Quickbooks Closing Entry.

From corehelpcenter.bqe.com

Checking your retained earnings CORE Help Center Retained Earnings Quickbooks Closing Entry Transfer all debit balances in expense accounts to the profit and loss account. For example, if the total expenses. Any income or expenses recorded during any prior fiscal year will show their money amounts and. Once you've closed your book, quickbooks will automatically transfer net income to retained earnings. Closing entries are entries made at the end of the fiscal. Retained Earnings Quickbooks Closing Entry.

From quickbooks.intuit.com

How to Find and Calculate Retained Earnings in 2024 QuickBooks Retained Earnings Quickbooks Closing Entry Cr income summary r 500,000. Once you've closed your book, quickbooks will automatically transfer net income to retained earnings. Closing entries are entries made at the end of the fiscal year to transfer the balance from the income and expense accounts to. Did you close equity into retained earnings for last year?at the end of each year, quickbooks. Transfer all. Retained Earnings Quickbooks Closing Entry.

From hirewriting26.pythonanywhere.com

Looking Good Equation For Ending Retained Earnings Peyton Approved Retained Earnings Quickbooks Closing Entry Any income or expenses recorded during any prior fiscal year will show their money amounts and. For example, if the total expenses. Did you close equity into retained earnings for last year?at the end of each year, quickbooks. Closing entries are entries made at the end of the fiscal year to transfer the balance from the income and expense accounts. Retained Earnings Quickbooks Closing Entry.

From qbkaccounting.com

Opening Balance Equity Experts in QuickBooks Consulting Retained Earnings Quickbooks Closing Entry Did you close equity into retained earnings for last year?at the end of each year, quickbooks. Transfer all debit balances in expense accounts to the profit and loss account. Once you've closed your book, quickbooks will automatically transfer net income to retained earnings. Cr income summary r 500,000. Closing entries are entries made at the end of the fiscal year. Retained Earnings Quickbooks Closing Entry.

From livewell.com

How Do You Calculate Retained Earnings On A Balance Sheet LiveWell Retained Earnings Quickbooks Closing Entry Once you've closed your book, quickbooks will automatically transfer net income to retained earnings. Cr income summary r 500,000. Any income or expenses recorded during any prior fiscal year will show their money amounts and. Transfer all debit balances in expense accounts to the profit and loss account. Did you close equity into retained earnings for last year?at the end. Retained Earnings Quickbooks Closing Entry.